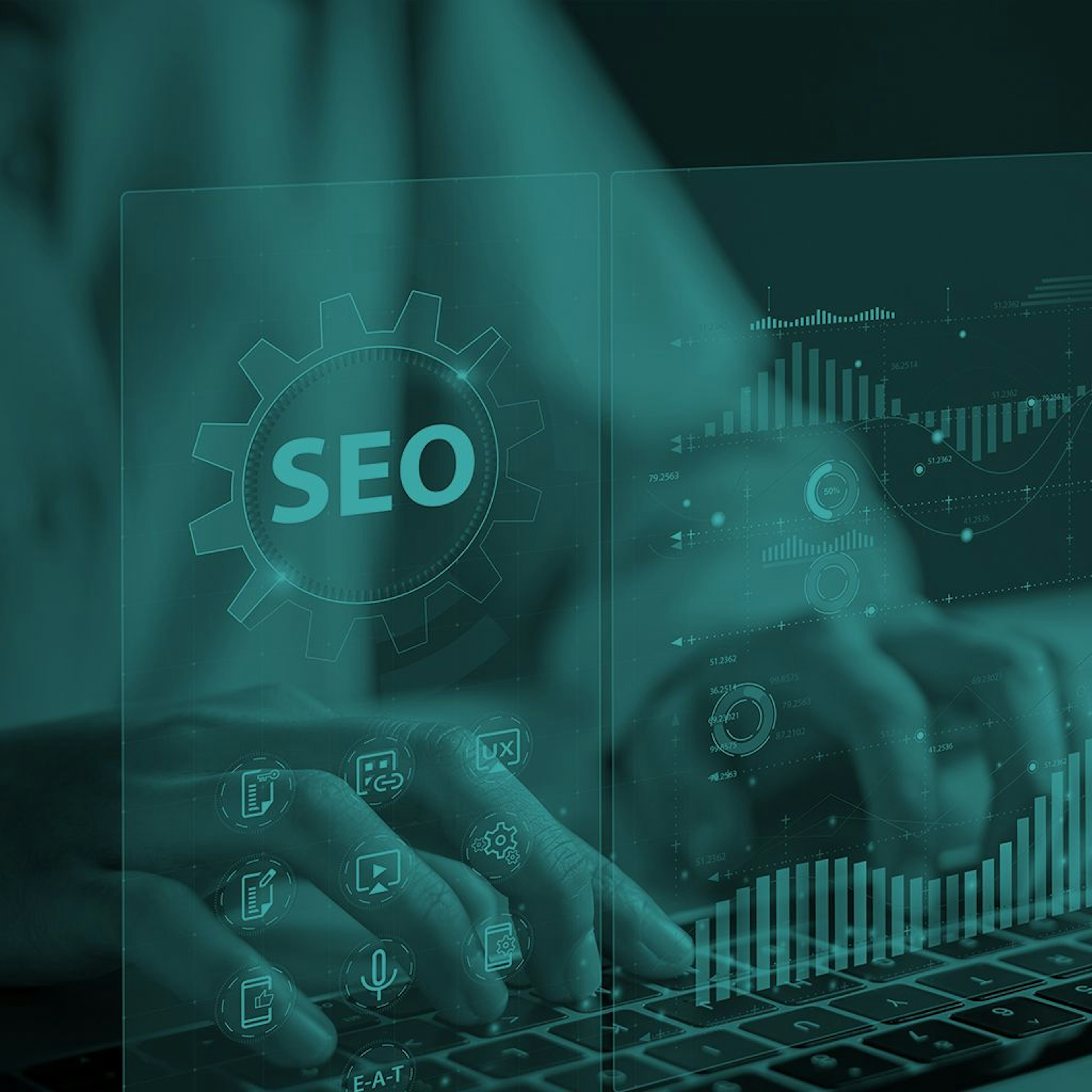

Helping Search Engines Understand Your Site With Good Website Architecture

If you’re new to website planning, don’t overlook the importance of the site’s architecture, which refers to how the pages and categories are organized. I like to think of a disorganized website like a grocery store that’s been restocked by someone who has never been in one before. If I venture into the dairy section and find milk, butter, and cookies, I might be delighted about the ext...

Read More