Check Your Reports: What’s Hiding In Your Non-Brand PPC Campaigns?

Our blog series, Check Your Reports, reveals a variety of common but valuable missed analyses and opportunities to improve marketing performance in e-commerce. Today, we will shed light on a surprisingly common SEM mistake that can negatively affect efficiency, and impact the way you invest.

We often find brand search queries mixed into non-brand campaigns when we audit accounts. This (presumably unintentional) mix falsely inflates non-brand performance, and can cause companies to spend much more than they should on campaigns not making the right impact. In this article we’ll walk you through why these two types of keywords need to be completely isolated in order to make smart bidding decisions.

Preamble

To set the stage, let’s start with some definitions so we can then move into a conversation about intent and conversion rates.

Brand Keywords:

A brand search is when users Google your company, brand, or product names. However — and here’s the catch — that’s not all. They also include all words and phrases that have a similar navigational intent, such as:

- Company name misspellings: LL Bean, L L Bean, LL Been, L Bean

- Exclusive product names: Double L, Bean Boots, Bean Bag

- Brand + feature: LL Bean fishing, reviews, sale, coupon code, etc.

- Brand + long tail: men’s red plaid flannel shirt llbean

- Domain: llbean.com

One important distinction is that keywords containing only other brands are not considered brand keywords for your company. For example, LL Bean sells merchandise from a variety of brands like Merrell or Darn Tough. We refer to these as “manu-brand” terms, where brand intent, which we’ll talk about below, is classified differently.

Brand Keywords:

Non-brand keywords are related to your product offering — they are basically any search phrase you would buy that does not contain any brand-driven terms. These are words and phrases used by those interested in what you offer whether or not they know your brand and shop with you.

Non-brand keywords can include:

- Head terms: Winter Boots, Flannel Shirts, Area Rugs

- Torso terms: Canvas Tote Bags, Wrinkle Free Dress Shirts, Wool Scarves for Women

- Long-tail terms: Men’s Lightweight Corduroy Pants, Women’s Duck Boots Size 7

Understanding Search Intent

Brand and non-brand keywords each have different search intent and they reach customers at different stages of the buying journey. When a user searches for your brand they’re using Google differently than when they search for a non-brand phrase. In short, brand-term searchers represent some of the most qualified, engaged, and high-performing sessions you can hope for. In all likelihood, someone searching for your brand terms is using Google navigationally to come to your site for something they’ve seen or want to research further. This type of session is much more comparable to a direct-load session than to a non-brand search session. There is a strong chance of conversion.

However, in this buying session, paid search isn’t what’s driving that sale or even the demand that drove the sale. Rather, this session is mostly influenced by the myriad of other marketing programs and assets, such as your retail footprint, catalogs, email, advertising, etc. That said, paid and organic search do drive a lot of brand demand, but only in non-brand sessions that lead to eventual brand queries. If I Google “duck boots,” and discover LL Bean on a train ride home, I may not buy during this particular session. I might then Google LL Bean later when I’m ready to make my purchase at home. Again, for our purposes here, we’re talking about brand search in this buying session.

Intent in true non-brand search sessions can vary widely. We know for certain the search query is somehow related to your product offering. These leads are more likely to be near the beginning of a user’s buying journey. The conversion prospects are lower, but the volume and the opportunity for new traffic are enormous, depending on your level of investment in top-of-funnel or mid-funnel sessions.

Segment Brand Vs. Non-Brand Terms In SEM Campaigns

So, we know for certain that brand terms will always outperform non-brand terms in search. Therefore, when campaigns don’t have a perfectly clean split between brand and non-brand keywords, it’s likely that brand data will falsely skew non-brand Return on Ad Spend (ROAS). This will lead to bad spending decisions.

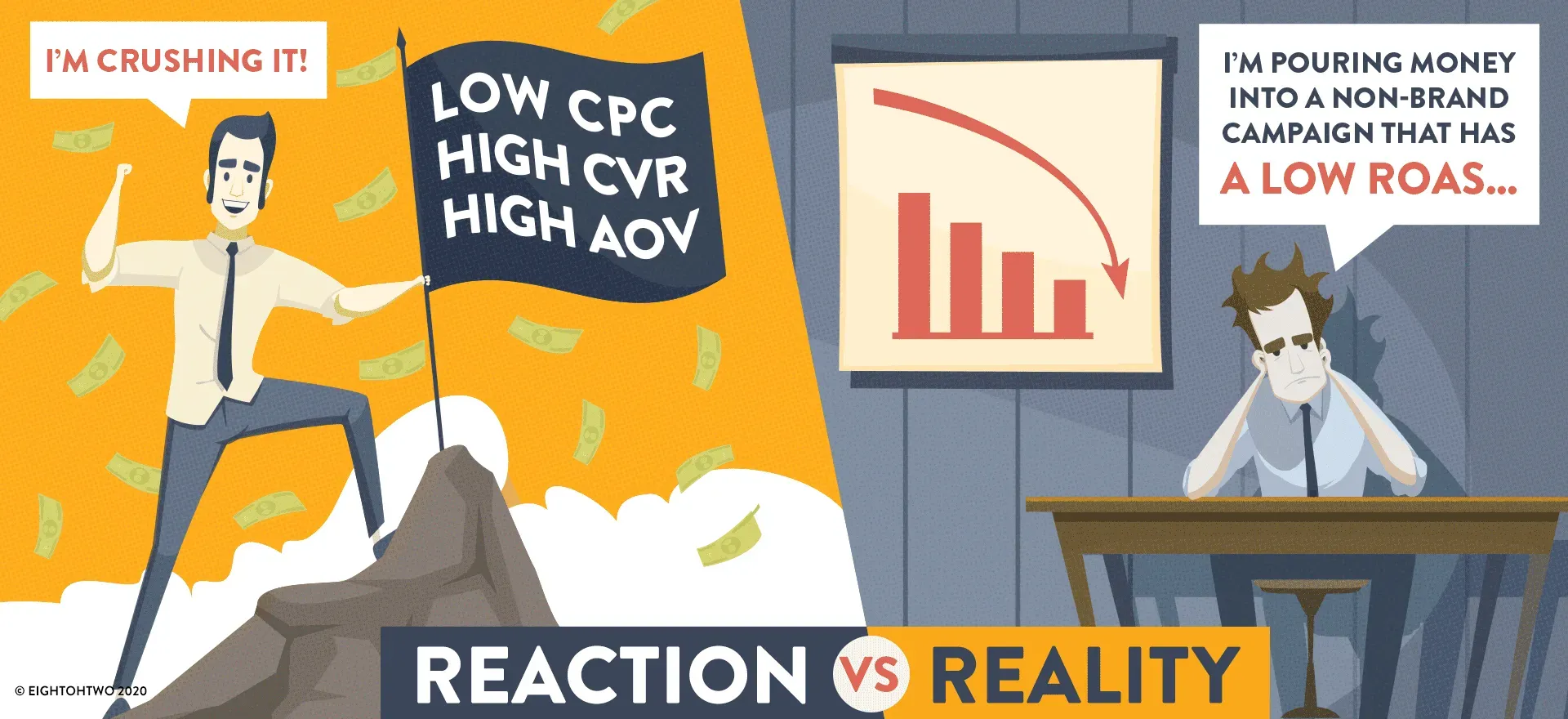

Your reports could be covering up non-brand inefficiency with strong brand-driven performance

As an analyst, if I think that a non-brand campaign is returning a 5:1, I will want to drive more traffic through it. But if brand terms are coming into the mix due to match-type usage or failure to add keyword negatives, the true non-brand performance may be much lower. Now, my incremental spend may be going out the door with a significantly reduced return, and I’ll be none the wiser since campaign reporting still shows a 5:1.

To properly segment your campaigns you have to build out separate campaigns and exclude brand terms from non-brand campaigns by adding a negative keyword list. Your negative keywords will ensure that any search queries containing brand terms, misspellings, domain, or exclusive product names will not trigger your ads. This will be especially important for dynamic search ad (DSA) and shopping campaigns; because these ad formats do not rely on specific keyword additions, it is much easier for them to inadvertently pick up brand traffic.

There is a lot of value in buying and owning your brand terms in paid search, but now that we know non-brand is not getting any credit for them, we can make smarter decisions about managing brand spend, too.

Skewed Results Will Impact Your Paid Search Investment

You can’t make smart decisions using bad data. Not segmenting brand and non-brand within paid search yields muddled data and inefficiency because it lumps together two radically different segments that require different treatment. In short, your reports could be covering up non-brand inefficiency with strong brand performance.

This distinction is particularly important for companies with a big brand presence, since reporting on combined performance can obscure changes happening in non-brand. It’s critical for omni-channel retailers who see surges in brand traffic with each catalog drop or commercial, where traffic and revenue wax and wane. If you have brand terms bundled into non-brand campaigns, the rhythm of performance changes will not line up with your non-brand tactical changes.

Further Troubles – The CPC Discrepancy

So, we understand that incoming revenue will be skewed higher for brand-driven terms, but another important note is that the cost per click (CPC) for brand terms is significantly lower than for non-brand terms. Due to high relevance, a brand term may cost $0.05 to $0.10 per click. This can lead to a lot of cheap traffic lowering the total average CPC for a campaign.

Non-brand terms have lower relevance to your landing pages, and the competition can be very high. In bidding wars, you may easily be paying ten times more for non-brand clicks than you’re paying for brand.

Cheap traffic that yields high conversion and average order value now compounds the skewed results for our most important metric in paid search which is ROAS or Return on Ad Spend. Even a small amount of brand traffic in a non-brand campaign can easily skew cost downward and revenue up to where the results are quite misleading.

Keyword Segmentation For Machine Learning

Separating out these two types of keywords in your reporting is more important than ever when AI and machine learning are given more responsibility for making bidding decisions. Providing inaccurate ROAS data can greatly impact optimization on the part of the algorithms. Imagine a scenario where you have a catalog drop on Monday, and a “non-brand” campaign with brand keywords sees very strong performance. On Tuesday, the algos will then allocate more spend towards a campaign that’s actually not driving the performance it appears to be for non-brand. If your analyst is asleep at the wheel, this can go on indefinitely.

Pro Tip – Talk to Eight Oh Two About Our Hybrid Bidding Methodology

All of this does not apply just to text-ad campaigns. Google Shopping now makes up 89% of non-brand paid clicks. As you increase your investment in Google Shopping, be careful to segment brand and non-brand for all the same reasons above.

Pro Tip – Segment brand and non-brand in Google Shopping by creating multiple campaigns with different ‘priority levels’ (Google Ads setting), and clever use of keyword negatives. In the simplest case, you’ll have one brand campaign and one non-brand campaign. Create a non-brand campaign and set it at a higher level of priority, and then add your brand keyword negatives. Create the same campaign at a lower level of priority, but don’t add brand keyword negatives. This is your brand campaign. The combination of priority rules and keyword negatives will ensure your high-priority non-brand campaigns capture the bulk of traffic, but your keyword negatives will allow brand traffic to trickle down to the lower-priority brand campaign.

Take The Next Steps To Improve Ad Campaign Performance

Now that you’ve developed a deeper understanding for how brand keywords can skew the performance data of non-brand keywords when combined, work with your search agency to ensure total separation of brand and non-brand keywords in your campaigns and data in reporting. Taking an honest look at non-brand performance is the best way to make smart bidding and investment decisions in two of your top digital channels.