If a search for financial SEO tips landed you here, you’re in the right place for best practices, ideas, and strategies to improve your business’s rankings. Your company may have a prime physical location, but this isn’t going to do all the client outreach for you. You’ll need to optimize your bank or financial business’s website to connect with consumers online.

An SEO strategy for banks (tailored to fit your company’s bandwidth and budget) and incremental changes go a long way toward overall improvement in search engine rankings. We’ve gathered some tips and ideas to help you get started.

1. Find Easy SEO Wins

SEO is a big deal for customer retention and acquisition, especially for smaller banks looking to compete against financial chains spending millions in marketing. Fortunately, financial institutions’ hefty budgets mean they must swing for the fences to recoup their spending, leaving easy wins for everyone else.

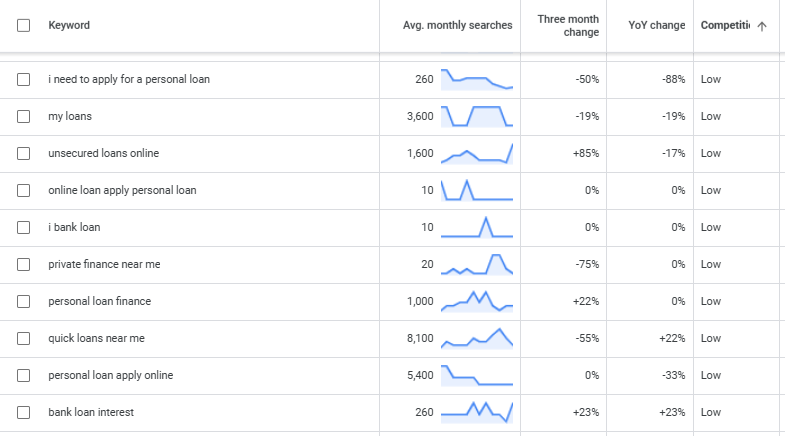

Banks that prioritize ranking #1 for ‘personal loans’ or ‘free checking accounts’ are often national brands with bottomless resources and many retail locations (or lofty paid search advertising budgets). Focusing on medium- or long-tail financial services keywords, such as ‘quick loans near [city]’ or ‘personal loan apply online,’ can help independent banks and smaller retail chains improve search rankings. We call these keywords “low-hanging fruit” because the opportunities are ripe and there for the taking.

By optimizing for a long-tail keyword like ‘free checking accounts in [City],’ a small bank targets the broader term ‘free checking accounts’ and the low-competition phrase ‘checking accounts in [City]’ giving the business more opportunities to rank.

The graphic below shows what I mean. These keywords are sorted to show low-competition terms that are easier to win yet still bring in sizable average monthly searches that improve visibility in the SERPs.

2. Enhance Local SEO

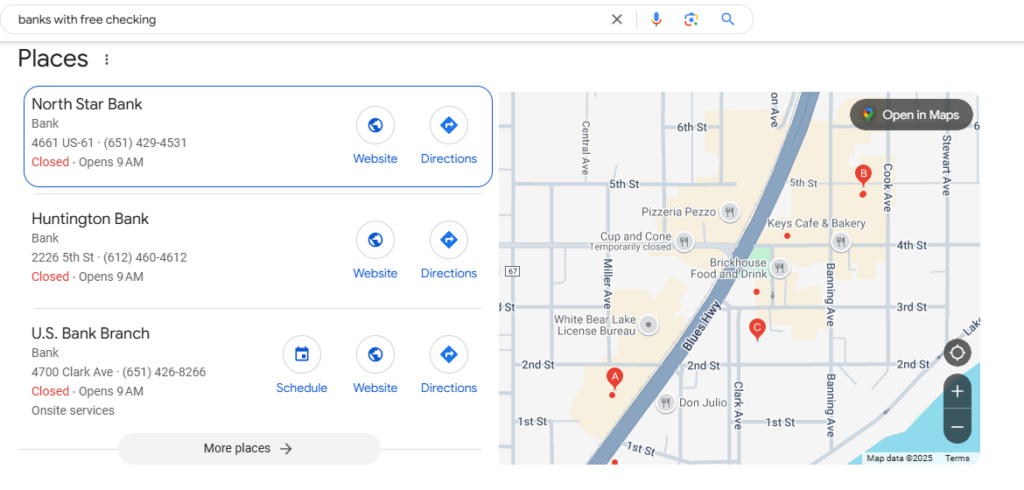

Despite people shopping online for everything from healthcare to clothing, consumers still prefer in-person banking and face-to-face financial service interactions. This preference for in-store experiences makes local SEO nonnegotiable for banks and financial service companies, especially since 86% of global survey respondents used a physical brand in the past year, and 45% did so monthly. Local SEO, or optimizing your website for geography-based keywords, helps search engines serve your site for people searching for ‘banks near me’ and ‘financial planners in [City].’

I talked to Sabrina Beaver, one of our local SEO experts who works with a few financial clients. Here are Sabrina’s five local SEO tips for financial services companies to improve visibility in the SERPs:

- Optimize Your Google Business Listing: Verify your contact details, financial services, hours of operation, and your business description are correct. Is your business listed on other online directories such as BBB.org, Yelp, or Bing? Make sure all NAP (name, address, and phone number) information is consistent to reinforce trust and relevancy. Be sure to update hours for unexpected closures and holidays, as well, to maintain a positive customer experience.

- Use Local Keywords: Incorporate location-based keywords like ‘financial planners in [City]’ in your website copy and headings. Also, optimize meta descriptions and page titles when appropriate.

- Publish Regional Content: Write articles about local laws, policies, or tax hikes affecting your client base to become a trusted resource for residents needing expertise.

- Increase Community Engagement: Sponsor events, scholarships, or food drives to earn backlinks from fellow businesses and news outlets, and interact with local audiences on social media to establish your presence.

- Encourage Reviews: According to a survey by Rivel Banking Research, 78% of banking customers consider online reviews when deciding on a new bank. In addition to driving customers to your bank, testimonials can also influence a financial institution’s ranking in the local pack, helping branches like North Star Bank outrank national brands as shown in the image below. Encourage customers to leave a review about their experience with your bank and respond to reviews in a timely manner. By responding to reviews, even the negative ones, it shows your business is engaged with their customers and their community.

3. Implement Financial Schema Markup

Structured data, or schema markup, is implemented in the backend of your website to explain to search engines (in a coded language) your business, its services, hours, and location. While this markup is smart for any industry, schema.org offers extensions specifically for banks and financial institutions to fine-tune Google’s understanding of your products, rates, and offers.

If you don’t have dedicated IT, consider asking an SEO agency for help with your financial services markup; when this is done right, your branch is more likely to be shown as rich results, a feature on Google that provides better visibility on the SERPs and improves click-through rates.

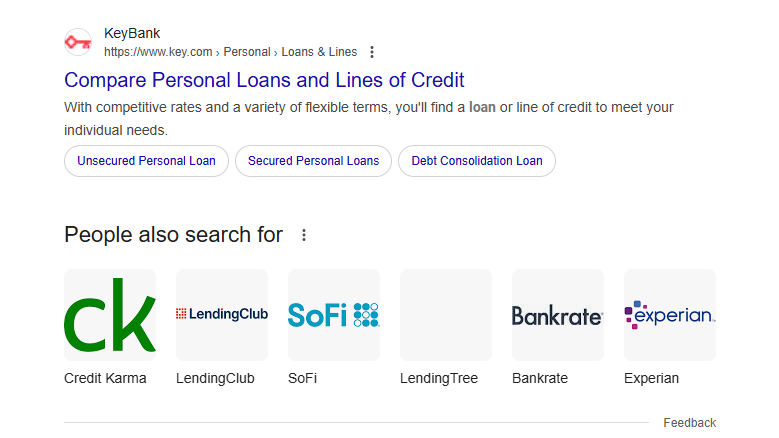

Take a look at two rich results I received for the search ‘4-year personal loan’ below:

The KeyBank listing features rich results called sitelinks, which direct people to their Unsecured, Secured, and Debt Consolidation loans. The “People also search for” results featured logos of financial service companies related to my query.

4. Focus on Site Performance

Your website is the first impression someone gets of your brand, and if your site is slow, glitchy, or unorganized, they’ll probably bounce to a competitor. If you think your website is “good enough,” consider that a top reason customers said they ditched their current financial institution was for a better digital experience. An optimized website design is a must to keep your bank branch off the chopping block.

Many factors can impact a site’s performance, but the technical SEO elements most important for banks are security, site speed, and navigation, including intuitive menus and helpful internal linking. Digital banking isn’t going anywhere and patrons expect easy, safe access to their accounts, from any device. anywhere. Since most technical SEO updates for banks happen on the back end, you may want an assist from an SEO agency for financial services companies. These specialists identify issues and compress images, minify code, manage redirects, and mitigate duplicate content that can slow a site and frustrate users.

5. Optimize for Mobile Banking Clients

Search engines favor sites optimized for mobile, as do banking customers. I’m sure you’ve run into an unresponsive website before—the text cuts off in the margin, the links are impossible to click, the buttons are too small, and page load times look like dial-up. Websites that aren’t responsive are hard to use and frustrating, and banking customers expect to check their accounts, apply for credit, or find information without a struggle. Banks and financial institutions only need to make a few adjustments to optimize a site for mobile, and the payoff of better customer satisfaction and higher rankings is worth the work.

6. Create Financial Content Customers Want To E-E-A-T

Financial consumers search for educational, transactional, and location-specific information, and your bank should focus its content marketing in each of these areas to meet customers’ expectations and drive traffic. SEO content for banks and finance planners should include a variety of blogs and industry articles, as well as calculator tools for mortgages, loans, and retirement.

If you’re reading this tip and thinking about passing writing on to AI, I implore you to reconsider. Any content you create must consider Google’s E-E-A-T rules: Experience, Expertise, Authoritativeness, and Trustworthiness. This is one area where AI can’t replace a human’s touch. E-E-A-T is appropriate for any business, but banks that may influence important financial decisions should be especially mindful. Rate any content against these E-E-A-T guidelines to make sure it passes Google’s sniff test and does your readers good:

Experience

Google wants evidence that you understand the product, service, or financial concept enough to write about it and offer advice. Content should include relevant opinions and recommendations quoting, or written by, an experienced team member. You can easily demonstrate the author’s qualifications by including the person’s job title in the author bio or linking to their LinkedIn profile or employee page on your site.

Expertise

Select spokespeople for content who are qualified and knowledgeable, such as a lending officer for loan rates and interest tips, or a wealth manager for retirement advice. Showing this person is qualified doesn’t need to be overly complicated. I find one simple but effective method is to feature a picture of an employee and tuck their name, job title, and quote about the topic underneath. This adds a nice personal touch and offers Google proof of expertise.

Authoritativeness

Google looks for quality indicators, like author credentials, company reputation, and testimonials, to verify a bank is a reliable source. (Encouraging reviews for local SEO and off-page SEO tips I talked about earlier also come in handy here.)

Trustworthiness

Does the content check all the boxes above, meet security requirements, and stick to Consumer Duty standards for financial institutions? Google trusts financial sites that:

- Offer quality content (no keyword stuffing!)

- Are technically sound with SSL certificates enabled and a sitemap available

- Are maintained to eliminate broken links and 404s and offer relevant links to other domains

- Have trusted backlinks from reputable websites and authorities in the industry

7. Build Off-Page SEO

Off-page SEO is built when other reputable domains and social media accounts vouch for your brand by mentioning your company or linking to your website. Unlike on-page optimizations—all the SEO tips I’ve talked about above—brands have minimal control over off-page SEO.

Rather than paying for links or hiding sponsorships that violate financial regulations, banks and financial brands must build backlinks by creating concise, quality content with market insights, infographics, and videos that other domains will want to link to. Another approach is to guest post on relevant industry blogs and publications.

A complete off-page SEO strategy for banks needs to include more than backlinks. Building an online presence through social media, garnering customer reviews and feedback from field experts, and prioritizing PR functions can help establish a financial institution’s reputation and authority, boosting its off-page SEO and rankings.

8. Monitor, Refresh, and Optimize Bank Content

I encourage any small bank to incorporate a robust SEO plan into their digital marketing efforts because it affords a nice balance to paid campaigns and continues to work long after the initial investment. (And if anyone can recognize the importance of a good investment…) But that doesn’t mean it’s a one-and-done solution. Interest rates, financial laws, banking services, loan terms, investment details, and financial best practices change from time to time—your website must reflect what’s current. This isn’t only necessary for customer satisfaction. Search engines also favor sites with updated, current content.

When you’re set up to monitor traffic and site performance, you can see how consumers’ search preferences change and respond. Refreshing blog posts with new target keywords, offering enhanced mortgage calculators and other finance tools, and developing articles to answer frequent questions or current topics help your business stay ahead of the curve and remain a trusted resource.

Implementing these eight tips to improve your local SEO and content strategy will get your website the visibility and traction it deserves. You may not be a pro at SEO strategies for banks, but we are. Whether you’d rather stick to financial planning and investments, or need a hand to get started, we’re here to help.