This was a collaborative project by James Glew and Zack Lawrence.

As marketers, our job revolves around delivering content to the right people, at the right time, in the right place. Platforms like Meta, LinkedIn, Bing, and Google all have their own tools and methodology for identifying the right users for your efforts based on location.

However, these tools are often explained through vague terminology, and to make matters worse, that terminology changes frequently. This becomes an issue when the tools are adjusted over time to serve those profiting from the platform, while ignoring what best assists those utilizing these platforms.

At Eight Oh Two, we strive to do more than just the status quo. We pride ourselves on creating solutions built around our client’s specific paid search needs. We designed our new strategy for Location of Interest Targeting in Google Ads to better help our clients.

First, let’s take it back a decade or so.

In 2011, Google made a significant update to its location targeting settings within Google Ads. This update introduced “people in, searching for, or viewing pages about my targeted location” as a new targeting option.

What Changed?

Before this update, advertisers primarily targeted users based on physical location. This meant ads were shown to users who were physically in the targeted region at the time of the search. But with its 2011 change, Google introduced a new way to reach users based on their interest in a location, rather than just their presence.

This meant that advertisers could now target:

- People physically in the targeted location.

- People outside the location but showing interest—either through searches related to that area or by visiting content about it.

For example, a hotel in Paris could now reach people in the U.S. searching for “best hotels in Paris” even though they weren’t physically in France. This was a game changer for industries like travel, real estate, and local businesses looking to attract non-local customers.

In 2023, Google quietly removed interest-only location targeting, replacing it with a default setting that lumps “interested in” together with “regularly in.” The result? Advertisers lost the ability to reach people based solely on their interest in a location. Now, if you want to target users who’ve searched for or engaged with content about a specific area, you’re also forced to include people who are physically there or frequently visiting.

For businesses like tourism, real estate, event marketing, or destination-based services that rely on interest-based location targeting, this wasn’t just a tweak. It was a total strategy shift. Previously, advertisers could target users anywhere who showed interest in a given location, such as someone in New York researching hotels in Miami. That level of intent-driven targeting is now gone, replaced by a broader approach that dilutes precision.

This one-size-fits-all default assumes “interest” and “presence” are interchangeable. Spoiler: they’re not. A Miami-based travel agency doesn’t want to target locals planning a staycation alongside out-of-state tourists researching a trip.

This move fits a broader trend of Google simplifying controls in a way that expands reach rather than refines it. If you relied on interest-based location targeting before, it’s time to rethink how you structure your campaigns, because that level of precision is no longer an option.

To attempt to overcome this, we decided to get data on national versus interest-only campaigns.

Today, most advice out there tells marketers to override Google’s default location setting (which includes both “interested in” and “regularly in”) and switch to “regularly in” only.

But what’s, well, interesting is that Google Ads doesn’t give you an option to do the opposite. To target only people interested in your business but not physically there.

That said, if you think outside the box with location targeting and exclusions, you can build exactly that.

Why We Focused on Location of Interest Targeting

One of our clients wanted to reach potential customers moving into their service area while excluding current residents. They’re up against well-known national brands and needed to build awareness with future locals before they moved in.

Since Google doesn’t offer an interest-only targeting option anymore, we had to get creative. The result? A setup that effectively recreated what Google took away.

Here’s How We Did It

Step 1: Identify Where To Target

Target your intended geographic area. If you’re a destination resort, that could mean the surrounding county. If you’re an internet provider, it could be your service area.

Step 2: Where To Exclude

Next, exclude the geographic region that encompasses your targeted era.

The idea here is to prevent people that live in your targeted area from seeing ads. As a general rule, in major cities, the Nielsen DMA region is going to be larger than the city or county, so you can go ahead and exclude that to be safe. The end result should look something like the map above, with your red excluded area slightly larger than your targeted locations.

Step 3: Now What?

When you look at the map version of your campaign’s target bounds, you may think to yourself, “Well, if I’m excluding the area I’m targeting, doesn’t that mean my ads just won’t serve?” If your ads were set to only target people physically in the selected area, then the answer would be yes, your ads would serve with limited spend.

But that is not what we are doing here. This campaign will serve as a more accurate national campaign, only showing ads to people that have shown an interest in your targeted area, according to Google’s algorithm.

Here’s What Happened: The Results

Going in, we were skeptical about what results the test would yield. In the end, we hypothesized one of three things would occur. These are the three endings we felt could have been in store:

- Boring Ending: Nothing will happen at all; the exclusions and targets will cancel themselves out.

- “We Just Made Another Local Campaign and Learned Nothing New” Ending (also boring): The target locations would override the exclusions.

- Good Ending: The exclusions overlaid onto the targeted locations with the interest and presence settings will only target users in the interested category and not the presence category.

Lucky for us (and for you), we got the good ending—and learned a lot in the process! We had ourselves a national campaign without targeting the entire United States. What’s more, the algorithm was also freed to use machine learning to identify users based on the quality of traffic.

Interest-Only vs. National Targeting: Winners and Losers

After launching our test, we initially planned to compare our campaign against a similarly designed national effort as our control. But what we found was that there was a much higher distribution of traffic towards the two states immediately surrounding our client’s service areas, North and South Carolina. With this in mind, we split our campaigns into two, one for the two Carolinas, and an expanded reach effort encompassing the rest of the United States.

This comparison will first look at how the two Carolinas performed across each campaign. Then, we will dig into the performance of the wider-ranging, expanded interest-only campaign versus the comparable performance of the control group.

Local

When we look at the state-level delivery of our campaigns, it’s clear that regardless of the way we leverage Google’s location-targeting setting, a majority of traffic will flow through the Carolinas. Over four months of delivery, 60% of all spend went to traffic from either North Carolina or South Carolina for the national campaign. These areas also received 58% of all spend from the interest-only efforts. So, there was not much of a difference; we can see what gets prioritized, and in most cases, it works.

The traffic from the Carolinas in the national campaign delivered clicks at a 40% CTR, double that of non-Carolina traffic. In the interest-only campaign, Carolina traffic saw a CTR of 37%, not far off from the national campaign’s Carolina performance. But here’s where the two paths begin to diverge. Unlike the national campaign, where Carolina traffic significantly outperformed other regions, the interest-only campaign showed a much smaller gap, just 3% higher than non-Carolina traffic. This effectively creates a campaign with a much more equitable distribution of traffic.

There are a number of reasons equitable distribution of traffic can be valuable in your campaigns. First, Google’s traffic is in many ways first-come, first-served. Lets look at how we manage daily budgets within Google. We don’t want to spend all our daily budget in the early hours of the night and have nothing left for the remainder of the day. In the same vein, why would we want to waste all of our spend and traffic on the best performing state, when there could very likely be more out there?

At the end of the day, Google doesn’t care about the success of our campaigns at the bottom of the funnel. Settings like broad match, or targeting the entire United States, are often the easiest way out, not the best way forward.

Now, to bring everything full circle, not only did having a more equitable distribution of spend at the state level help us identify new markets, it actually impacted how we spent in the interest-only campaign.

Our odd-hours spend (early morning, late night) was 24% lower in the interest-only campaigns than in the standard national campaign. Additionally, we saw 10% more spend going to traffic between the hours of 12 p.m. and 6 p.m.

Now how did this impact our KPIs? At the end of the day, the conversion rate for the interest-only campaign was 39% higher than that of the national campaign. With a down-funnel focus for these campaigns, this was the kind of performance we wanted to see.

Based on this data, interest-only campaigns focused on the immediate vicinity of service areas can be a strong addition to best-practice strategy. Our local campaigns do extremely well, they target the immediate service areas of our efforts, and they have more efficient CPCs and CTRs than their national counterparts. However, their geographic targeting is limited to users currently within the service areas. This creates a blind spot, since they are unable to reach potential customers in other states or cities who are planning to move, or not currently in the area.

National

This is where our national campaign comes in. We leverage these efforts to expand our reach to prospective customers not currently in our service areas. It’s a key element of our strategy around new customer acquisition. Notably, the CPC of national efforts is typically 12% higher than that of local efforts. Our cost per conversion is 38% greater, and CTRs are 37% lower. This campaign casts a wide net, and tends to spend more in areas with larger populations, as a general rule.

There’s nothing wrong with this on principle. It’s a tried-and-true best practice that companies and agencies have been using for years. However, just because it ain’t broke, doesn’t mean we can’t make it better.

Similar to our national campaigns, our interest-only campaigns target a much wider geographic location than the local campaigns. Unlike the national campaigns, the interest only campaigns will distribute their spend based on where the most interest lies in our service areas, not based on the volume of users. It’s a quality-over-quantity situation, and quality is what we want.

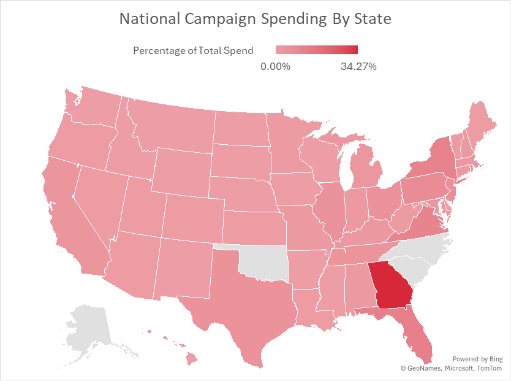

At first blush, both of our campaigns had one thing in common. The majority of the spend by state went to the same top three states (after the Carolinas). Georgia, Florida, and New York comprised 50% of all spend for our national campaign, but only 42% of all spend for the interest-only campaign. That’s our first improvement: We can see the amount of spend going to the top three states decrease, and the average spend per state increase. Even more significant is that within the national campaigns, Georgia delivered 34% of all spend outside of the Carolinas. Our interest-only campaigns spent half as much on Georgia. In aggregate, the interest only conversion rate was 54% higher than that of the national counterpart.

So, What Can This Teach Us?

These are promising initial results. Beyond adding niche capabilities to our national campaigns, interest-only geo-targeting has the potential to identify new areas for expansion and focus.

There are a few things we can definitively say based on our experiment.

- Interest-only geo-targeting was removed in 2023 to promote algorithm-driven tools that serve to profit Google’s bottom line before that of advertisers.

- Location of Interest Targeting is more efficient at driving targeted traffic than national campaigns targeting the same area for “users that are regularly in that area.”

- Interest-only campaigns incorporate machine learning to deliver higher quality traffic that converts down funnel at a greater rate than Google’s “best practice” alternatives.

This is only the beginning of this new strategy, and more testing will be needed in order to uncover what else it is capable of when implemented correctly. Want to see how Location of Interest Targeting can strengthen your campaigns? We’d be happy to dig in and discuss strategies. Reach out to us using our contact form, or connect with us on LinkedIn.