Authors: Caitlynn Goheen, Emily Myers, James Glew, Morgan Ferriss, Tim Spencer

Google’s Think Retail is an annual virtual event for everyone with a stake in retail marketing operations. This year, the 3-hour livestream event was held September 10 and included presentations on everything from YouTube to AI Max. Well, really, that’s all they covered—plus a few mentions of Demand Gen.

In 2025, the internet has become more than a simple tool used to find answers on a single search engine. Although Google still leads the pack, as it has for decades, it’s clear that it’s not always the search engine people prefer. The pervasiveness of TikTok, Instagram, and YouTube (another Google favorite) means that advertisers are adapting to a world where search goes far beyond traditional search engines.

Although it functioned primarily as a sales pitch for why marketers should “stay on Google,” this year’s Think Retail session also covered a few upgrades to existing strategies and a smattering of success stories from industry leaders.

Our Playlist: The Biggest Takeaways From Google Think Retail 2025

As savvy marketers, we attended the session, took copious notes, and put together our most important findings here. Read on for our breakdown of the most important takeaways from Google Think Retail 2025, plus tips and tricks you can put to work this holiday season:

- AI Max Is a Work in Progress

- Don’t Discount YouTube’s Massive Reach

- Pair Broad Intent and Branded Search

- Don’t Sleep on Hidden Holidays

- Take Risks Before Q4

- Understand the Power Pack for Retailers

- Use GA4 for Cross-Channel Measurement

- YouTube Shorts Are Coming After TikTok

- Niche Opportunities Can Equal Widespread Success

- New Prospecting Features Are Coming

- Loyalty Programs Enable Personalized Messaging

- Traditional Tactics Are Not Obsolete

1. We Know Google Is Pushing AI Max for Search. The Real Question Is Why?

At the heart of Google’s push for AI Max for Search is its dependence on scale. The more data it can consume, the smarter and more effective it can become over time. That hunger for data is likely what makes adoption so critical to prove its long-term success. But the flip side is a product that feels like something of a black box. Advertisers see fewer insights and have less room to challenge results, yet carry the burden of increased spend. It’s a structure that benefits Google most while asking marketers to take a leap of faith.

“We’d love to see the incremental conversions driven by unique and long-tail searches like the DSAs of yesteryear, but AI Max just isn’t ready to take off straight out of the box.” –Emily Myers, PPC Specialist

Throughout the day, Google missed zero opportunities to brag about the supposed advantages of leveraging AI-driven creative and campaigns. But our takeaway is not aligned with Google’s messaging here. We’ve all seen it with broad match in the past, and AI Max for Search is shaping up to be Google’s newest flagship product. For more about how we’ve scaled up our use of broad match keywords, read our blog series on leveraging automated guardrails for broad match to innovate and drive incremental growth.

Tools are launched with the intent of their creators in mind, and here’s what that means for us as marketers: We must be wary of hastily rolling out any new activations before vetting test results and actual performance.

When it comes to AI, the proprietors of tools have more often than not created a structure that favors maximizing spend over all else—including accuracy. It’s difficult to get the best of both worlds, but not impossible. Scaling through AI can absolutely be done through the use of stringent guardrails that prevent wasted spend and overinflated improvements.

“AI can scale fast, but without the right creative direction, it scales mediocrity just as quickly. Guardrails, like text guidelines for AI Max for Search, are a necessary activation to keep automation in check. If they work as intended, they could help us scale without sacrificing quality or a brand’s image and strict guidelines.”

–Caitlynn Goheen, Director of Paid Search

“I love that the biggest update to AI Max isn’t about adding more, but about tightening things up. The new text guideline feature feels like a smart way to keep AI from going off the rails with sloppy copy. If it works the way it’s intended, it could be a game-changer for scaling campaigns without sacrificing quality.” –Tim Spencer, Senior Paid Search Analyst

2. Everybody Uses Google, and YouTube Is Just as Big

Sessions touched on the breadth of reach afforded by AI-driven Google search methods and the general reach of YouTube as a channel, making it easy to forget companies other than Google even exist. Plus, in Google’s words, YouTube creators are among the “most trusted” in the world, really hammering home their “product confidence.” And, of course, the dominance of YouTube over cable TV was mentioned more than a few times.

But we all know that comparing YouTube to traditional cable advertising is not a fair view of the landscape. We agree that YouTube is going to be more valuable than standard TV, but this is not a groundbreaking announcement. (In fact, they basically said the same thing last year). The data proves this: YouTube’s ROI and level of control consistently outperform linear TV across the board.

Another metric touted throughout the day was that of the widespread adoption of different AI channels, even going so far as to claim that there were two billion users of AI Overview (about 25% of the planet) and 100 million monthly active users (1.25% of the globe’s population, if you’re keeping score, according to an AI overview).

This holiday, shoppers will be comparison shopping across several platforms, including YouTube and Google. Top video categories—product reviews, unboxings, and branded hauls—are more popular with consumers and more relevant to retailers than ever before. With much of this massive customer base searching with broad intent, leveraging trusted platforms to help customers explore their options is going to be key.

“Shoppers have been looking to user-generated content on YouTube like hauls, lists, and reviews to inform their shopping decisions for years, so if you haven’t taken advantage yet, you’re behind the curve. However, the Creator Partnership hub is giving you an easy opportunity to catch up.” –Emily Myers, PPC Specialist

Hidden Data Points in Google’s Story Line

Throughout Think Retail 2025, the slides mostly contained information that was either already known (“Ever heard of a little site called YouTube?”) or clearly cherry-picked for promotional purposes (“One click to get 27% more conversions through AI Max”). But we did find two overlooked statistics that we will be keeping in mind this holiday season

3. Broad Intent and Brand Search Across Channels

Over 71% of customers are taking an omnichannel route to purchasing decisions this holiday. Younger generations skew even higher in Google’s data, and we trust this assessment more than some of their other numbers (looking at you, AI Max).

Optimizing to store goals, leveraging multichannel Performance Max (PMax), and other elements of conscious strategy all play a role in reaching your customers in the right place at the right time to drive success. One of the best ways to do this is through PMax campaigns, which are just as important in 2025 as they were in 2024, and won’t be going away any time soon. (We’ve got everything you need to know about running a successful PMax campaign.)

It was also noted that 60% of shopping and apparel searches show broad intent. The speaker didn’t define what “broad intent” meant in this context, but her examples—outfits for summer wedding, comfortable running shoes—paint the picture of the definition used for “non-brand traffic.”

If we take this at face value, knowing that 60% of all shopping and apparel searches are non-brand, it’s notable that 40% are branded searches. While not the majority, this statistic shows that just under half of all searches include a brand name, whether it’s yours or your competitors.

“I wish there had been more detail on search trends going into the holiday. Unfortunately, most of the content around holiday shopper behavior was limited to what YouTube genres are expected to be big this year. The problem with this is that when corporate keynote speakers are significantly removed from the generation at the center of discussion, and lack an awareness of the space beyond their careers and the industry, it can come across as a brazen attempt at relevance and rarely sticks the landing. “ –James Glew, Paid Search Analyst

4. A Hidden Holiday? Cyber Week Before Cyber Week

Now let’s talk about the most exciting thing Google didn’t talk about. An overlooked statistic on a slide that was breezed through during the sessions belies a subtle opportunity for retailers for holiday 2025.

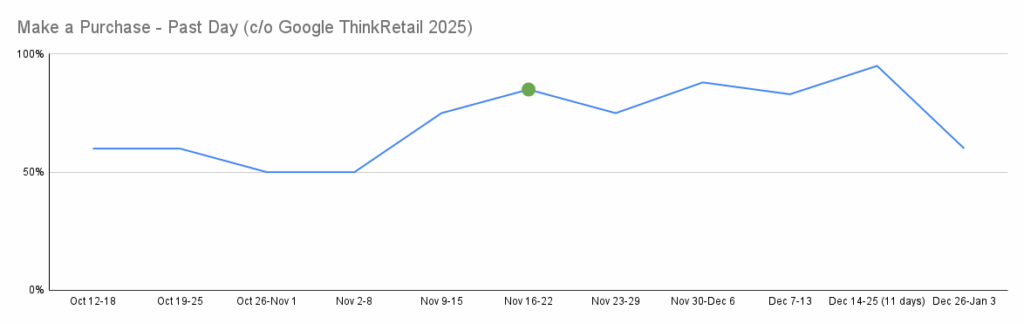

The graph below was intended to underline the timeline of Q4, highlighting the (somewhat vague) statistic that “50% of shoppers are making holiday purchases all the time.” Upon closer inspection, the data points out something more important.

Two weeks before Thanksgiving, consumers were making as many purchases as on Thanksgiving itself, and nearly as many as in the lead-up to Christmas. Nearly 85% of shoppers in the week of November 18 purchased in the past 24 hours, a brief peak in traffic before the expected standard holiday season.

(By the way, the date range including Christmas is nearly twice as long at 12 days versus the other points on this graph, probably to show a peak to corroborate Google’s story. We’re gonna chalk that one up to “creative math.”)

“That pre-Thanksgiving spike really stood out to me. If it holds true again, it could change how we think about budgets. Suddenly, mid-November might be just as important as Black Friday itself.” –Morgan Ferriss, Paid Search Analyst

Although this data point is unique to this survey, it’s an overlooked detail that we will explore this holiday season through a dedicated budget allocation during the mid-November spike. There are also opportunities for early sales promotions, as shoppers begin to fully get into the holiday groove before the typical gifting season arrives.

5. Taking Risks Ahead of Q4

Whether it was from leading names like Aritzia or the fledgling upstart Boll & Branch, industry leaders were consistent in underlining the performance of testing ahead of peak periods. This is true today more than ever. Testing ahead of peak periods means that the impact of seasonality will play a role in your results, but learnings from the rest of the year allow marketers to implement strategies they believe in during the most important time of the year.

“The biggest wins we’ve had during Q4 didn’t come from playing it safe. They came from testing bold ideas ahead of the season and being nimble, learning quickly, and pivoting when performance warrants it. Tactics proven before the holiday season scale harder when it counts. But the inverse isn’t true; Q4 insights rarely apply to other times of year. Holiday behavior is unique, and testing during Q4 often only tells you how people shop in Q4. If you want results you can actually use, test before the rush and activate with confidence.”

–Caitlynn Goheen, Director of Paid Search

Take Boll and Branch, who stated the need for bravery when it comes to taking risks and launching new campaign strategies. Boll & Branch did this through breaking out their product bundle offerings into their own PMax campaign, which led to increased sales in Q4 (when 40% of their business happens).

We’ve seen it, too. Just this year, we observed that breaking out bundled product campaigns independent of catch-alls boosted ROAS efficiency by more than 36% without a reduction in revenue. As one team member aptly pointed out, this is far from a daring new concept—it’s a simple go-to optimization.

“Breaking out PMax into smaller dedicated campaigns can definitely have a big impact on performance, but it’s not a revolutionary strategy in 2025.” –Emily Myers, PPC Specialist

That’s just one of the many tests we launched this year, and we will be leveraging it this holiday season and in the years to come.

6. The Power Pack for Retailers: PMax, AI Max for Search, and Demand Gen

Google’s Power Pack is the company’s own version of a bundled product. In our experience, you will see strong performance if you leverage the tools in concert with one another, but that’s not an excuse to set it and forget it once you have three campaign types live.

PMax, Demand Gen, and AI Max each have their quirks. We already went through the ins and outs of Google’s AI, and although it’s undoubtedly the biggest player in the power pack, PMax got little screentime relative to Demand Gen.

And when we say Demand Gen, we mean YouTube. If you just looked at the imagery in play here, you’d forget that Demand Gen does anything other than Video Ads.

Regardless of what Google wants advertisers to buy into, it’s true that some elements of the power pack for retailers will drive success. We wholeheartedly support leveraging PMax to expand campaign reach, grow your customer base, and drive incremental revenue. There’s no better time to start than today, before the peak of the holiday season.

7. GA4 Cross-Channel Measurements

Google briefly mentioned Meridian, a next-generation marketing mix model. While we didn’t get much as far as details, the promises are lofty: Google’s hoping to deliver us a unified view across channels.

We know that the results will only be as strong as the quality of the data the model works off of. We also know from experience that Google won’t play nicely with non-Google data sources, if it plays at all.

Triple Whale, RockerBox, and other industry mainstays have built businesses around multi-touch attribution, so this move positions GA4 as a challenger. We’re going to need to see the results from this AI-powered underdog from Google, who has never had a stake in this race until now. In the past, attribution has been a messy job for many, and it comes to a head when advertisers are forced to balance accuracy against practicality across channels.

“Cross-channel attribution has always been messy, and GA4 won’t magically fix that. I can’t help but feel like this is another way for Google to tighten its grip and nudge us into spending more inside its ecosystem. If the data from non-Google channels is shaky, but the Google side looks polished, you already know which story will get pushed. That imbalance makes me question whether this tool is built for advertisers—or for Google’s bottom line.”

–Morgan Ferriss, Paid Search Analyst

As we’ve seen with new tools like AI Max and PMax, the data Google uses and even the results delivered are often hidden in a black box. If and when we’ll see Meridian lacks transparency, and it’s going to take time for its full capabilities to be revealed.

The biggest question we have here is: Will GA4’s attribution be transparent enough to drive confident decision-making, or does it risk being another “trust us” scenario? Our takeaway at the end of the day is to treat this as a directional tool, pairing it with other time-tested attribution methods until we see solid results.

8. YouTube Shorts Is Coming for TikTok

Another claim to fame covered in Think Retail was the growth of YouTube Shorts, the new golden child of Google’s family. Based on a February 2025 survey featured in the deck, 45% of Shorts users don’t use TikTok, and 65% of Shorts users don’t use Facebook Reels.

It’s not all roses, though, as the YouTube Shorts channel has drawbacks of its own that were not mentioned by the experts at Google.

“I absolutely appreciate the effort made to underline the value of running ads on YouTube Shorts, and Google’s numbers confirm the widespread adoption worldwide. I also agree that content creators are absolutely going to be perceived as more trustworthy by today’s shoppers versus overly polished and antiseptic content coming directly from brands. But I take issue with how many of the discussions around video ads, especially YouTube Shorts, were twisted into ‘pick us over TikTok’ elevator pitches by the Google Team, when the decision is arguably more nuanced than just that.” –James Glew, Paid Search Analyst

CTR for Shorts videos is typically up to double that of standard video. But there is a tradeoff. Due to the fast-paced nature of the vertical scroll, we see video rates as much as 75% lower than standard video in Shorts campaigns. You may be getting a more engaged user who is working their way down a crowded funnel, but there’s something to be said about the reduced attention span that comes with short-form content placements on mobile devices.

9. Niche Opportunities for Growth With Video Ads

On the other end of the YouTube spectrum, standard video ads got a surprising vote of confidence from industry leaders during the session. Walmart’s Jill Toscano called out a success story wherein the team identified an opportunity to expand their reach through entering a niche corner of YouTube.

Walmart launched a set of shoppable ambient noise YouTube videos—each prominently featuring their products—that were meant to function as scenery while prospective customers multitasked. Walmart also leveraged shoppable product tags within their content, so customers could go from click to purchase without having to look for a link in the description.

“While most may not have the creative budget of Walmart, getting to know the types of videos your customers are watching and tailoring your content to blend in seamlessly is a strategy that could benefit lots of retailers.” –Emily Myers, PPC Specialist

Whether it’s discovering Walmart’s penchant for virality through white-noise content, or pointing out the tip of the Spanish-language iceberg and unlocking our own Search campaigns, we value ingenuity and curiosity as a mindset. The ability to identify growth opportunities, no matter how seemingly narrow, can precede shifts in campaign strategy with massive impacts.

10. New Prospecting Features and Audience Exclusions

Also announced at Think Retail was a suite of new prospecting features ahead of the holidays. The ability to narrow your audience to new customers by excluding existing customers and other cohorts is a fantastic update. We can now exclude:

- Existing Customers

- People searching for your brands

- People who clicked on your ads or content on Google or YouTube

New customer acquisition tools are valuable, but nothing groundbreaking at this point. For most retailers, the top priority is growing the customer base. New customer acquisition features in Google’s campaigns are an integral part of any strategy working towards that goal.

But Jyotika Prasad at Google also announced that new customer retention and loyalty tools are coming down the pipeline.

11. Loyalty Program Messaging in Google Merchant Center

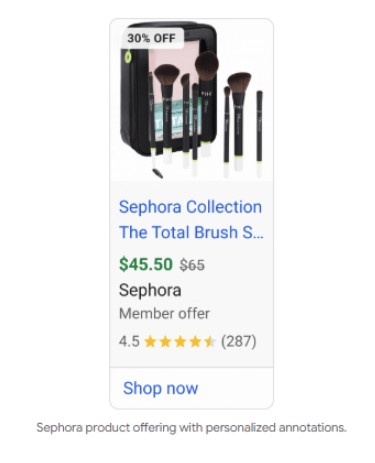

The first of those customer retention tools is the ability to tailor messaging to loyalty program members. In Sephora’s success story of the day, they added a “member offer” annotation to ads shown to loyalty members during their annual sale and saw a 20% increase in CTR.

A few grains of salt on this one: Google and Sephora do not say what the control group was in this experiment, and we know from experience that loyalty segments often have a ROAS that is significantly higher (over 200%, if not more) than non-loyalty program customers. That’s why it’s important to properly conduct tests.

“I love the idea of being able to further tailor loyalty messaging, but we need to be realistic in understanding that loyalty customers already outperform. Something I am most curious about is proving the incremental lift, not just showing strong numbers from an already engaged group.” –Morgan Ferriss, Paid Search Analyst

Even though it wasn’t a clean experiment, Sephora saw an impact from the personalized messaging. This is a great tool to put to use for retailers with loyalty programs this holiday season.

12. Traditional Tactics Are Not Obsolete

One thing no one mentioned throughout the event is the fact that if you don’t manage your campaigns properly, there’s a very real risk of wasting budget. An added nuance to this is the default bias engineering built into many of the new features, including broad match and now AI Max, that can rapidly scale up low-quality traffic without the proper guardrails in place.

In fact, throughout the sessions there was only one dissenting voice when it came to the push for “shiny new toys.” Jason Goldberg of Publicis adeptly stated that traditional tactics are not obsolete.

“We’re not in the business of blindly adopting every new tool Google rolls out. We test, challenge, and adapt, because thoughtful performance beats the default every time.”

–Caitlynn Goheen, Director of Paid Search

As marketers, we need to make sure we don’t disregard the breadth of strategies that have been tried and true for much of the past decades. When the all-too-frequent question of “Are old [match types, campaign types, etc.] going away?” was asked, Jason answered with a resounding “no!”

“I love that at the close of the sessions, we heard a more honest take that ran somewhat counter to the narrative of the day. Some may call it old-fashioned, but sometimes a simpler sensibility is needed to cut some of the aggressive push into the future that we’re seeing in the industry. AI isn’t everything, and it’s not going to be everything. “ –James Glew, Paid Search Analyst

This calls to mind the utility of exact and phrase match keywords, and to an extent, even broad match. These match types are ultimately the foundation of Google’s offerings, and won’t be leaving our toolbox any time soon—or ever. As always, the perspective that AI should be a tool to aid, not replace, human beings is more and more relevant as we head into this uncertain future.

Want to see how our PPC team can deliver for you and your clients? We’d be happy to dig in and discuss strategies. Reach out to us using our contact form or connect with us on LinkedIn.