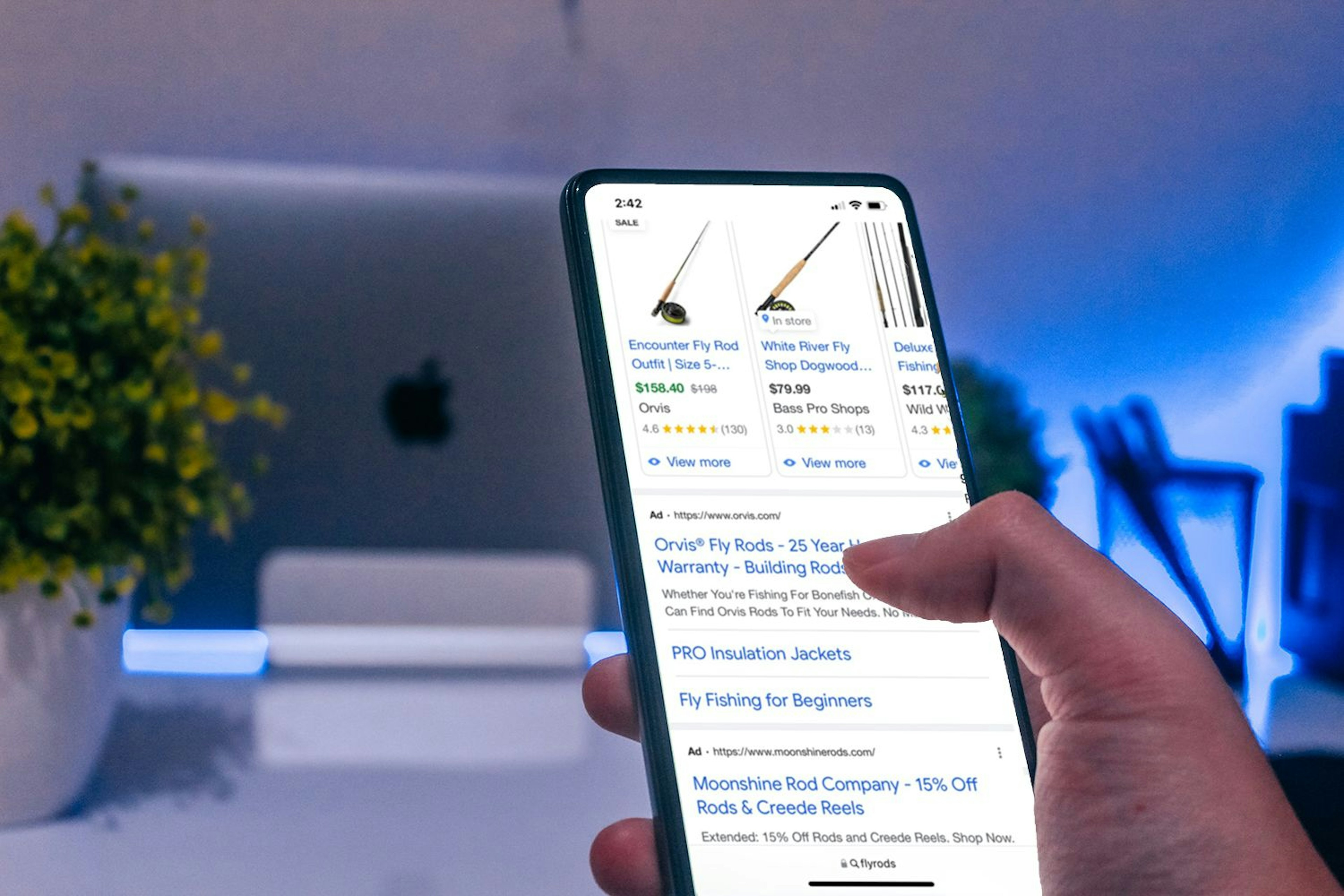

Paid Search Advertising

Our approach to Paid Search is simple. Diligent stewardship and vertical experience plus machine learning and technological guard rails yield a controlled environment that’s conducive to learning and predictable growth. Over the past 15 years, we’ve developed a disciplined methodology that will shed new light on opportunities you may be missing.

Our meetings with you are about finding the next win. Through careful data analysis and competitor review, we come to you with customized, actionable reporting and recommendations for how to take your campaigns to the next level. Your dedicated account rep and analyst team will always have their collective finger on the proverbial pulse!

Let us provide a free campaign audit to show you missed opportunities.

Merging the best of machine learning and human intelligence.

Bid Fusion — Hybrid Bid Management

Bringing machine learning and human intelligence together.

Automation has revolutionized paid search management. Its ability to process massive data sets — uncovering thousands of signals that can impact the value of a paid search click — can lead to increased efficiency and scalability. But algorithmic bidding alone is not enough. Data requires interpretation and context.

That’s where human intelligence comes in. With 15 years of vertical experience, our richer understanding of context allows us to improve upon automation by "guiding" it through periods of conversion rate volatility, seizing short-term opportunities for incremental revenue, and generating cost savings after a trend has subsided.

Smart Structure for Google shopping

Better segmentation, better outcomes

Proper campaign structure leads to improved data flows, yielding better information for both algorithm and analyst. Smarter segmentation of your shopping campaigns provides increased transparency, making it easier to catch onto significant trends quickly — and take action.

By incorporating product margin data, category/subcategory performance, conversion volume and more, we create campaigns tailored to your business goals. The process is dynamic, with campaigns continuously reviewed and revised as your revenue grows.

The Eight Oh Two Value Proposition

Best in Class

Eight Oh Two was recently dubbed “Best in Class” for skill by Google. We work with a dedicated team at Google who will support your account with strategy, demographic research, test recommendations and more.

A Unique Approach to Management

We stand by a hybrid approach to campaign management, marrying automations and human expertise. This approach ensures you’re getting the best value from our experience along with the safety net of automated bidding.

Diligence and Dedication

The team you work with at Eight Oh Two will have a small client load so that they can give you the attention you deserve. We’re not afraid of long cyber-week hours, and we’ll provide regular, conscientious feedback and recommendations on strategy. The folks you talk to on the phone are the same ones working on your campaigns — we keep an open and running dialogue for as long as we have your account under management.

Experience

Our team’s experience spans a wide range of verticals, though we have a strong affinity for ecommerce retailers. Ask us about our case studies!

Customizable and Actionable Reporting

We are all about analyzing data to spot trends, successes, inefficiencies and opportunities. Reporting is a means to an end, and our team is highly adept at reading data to bring you the information that matters most.

Ready to get started?

Let us provide a free campaign audit to show you missed opportunities.